What are the risks of state minimum auto insurance coverage in South Carolina?

September 20, 2024

In South Carolina, like many states, drivers are required to have auto insurance to legally operate a vehicle. However, the state’s minimum coverage requirements may not be sufficient to protect you in the event of a serious accident. While opting for the minimum coverage might seem like a cost-effective solution, it can expose you to significant financial and personal risks. Here’s a closer look at the dangers of sticking to state minimum auto insurance coverage in South Carolina.

Understanding South Carolina’s Minimum Auto Insurance Requirements

South Carolina mandates that drivers carry the following minimum auto insurance coverage:

**Bodily Injury Liability:** $25,000 per person and $50,000 per accident.

**Property Damage Liability:** $25,000 per accident.

This basic coverage is designed to meet legal requirements and provide some level of protection for others on the road. However, these limits are often not enough to fully protect you or others involved in a serious accident.

1. Inadequate Coverage for Serious Accidents

The minimum liability limits in South Carolina might not cover all expenses associated with a severe accident. Consider the following scenarios:

- Medical Costs: If you’re in an accident where the medical expenses exceed $25,000 per person, you’ll be personally responsible for the remaining costs. Medical bills can quickly add up, especially if there are multiple injuries or long-term treatment required.

- Property Damage: If the damage to property exceeds $25,000, you’ll need to cover the additional costs yourself. This can be particularly concerning if the accident involves expensive vehicles or significant property damage.

2. Limited Protection Against Uninsured or Underinsured Drivers

In South Carolina, like elsewhere, some drivers may not carry adequate insurance coverage. The minimum policy doesn’t include protection for uninsured or underinsured motorists. If you’re involved in an accident with a driver who lacks sufficient coverage, you could be left to cover your own medical expenses and property damage.

3. Absence of Comprehensive and Collision Coverage

State minimum coverage does not include comprehensive or collision insurance, which can be critical:

- Collision Coverage: This helps pay for repairs to your own vehicle after an accident, regardless of fault. Without it, you’ll bear the full cost of vehicle repairs or replacement if you’re in a collision.

- Comprehensive Coverage: This covers damages to your vehicle from non-collision incidents such as theft, vandalism, or natural disasters. Without comprehensive coverage, you risk paying out-of-pocket for these types of damages.

4. Personal Financial Exposure

If you’re involved in an accident and your coverage limits are insufficient to cover all damages, you could face substantial out-of-pocket expenses. This could lead to financial strain, including potential legal judgments and wage garnishments if you’re sued for damages exceeding your policy limits.

5. Legal Consequences

Being underinsured can result in not only financial difficulties but also emotional stress and legal issues. The strain of covering additional costs beyond your insurance policy can be overwhelming. Furthermore, you may face legal complications if you’re unable to fully compensate others for their damages.

How to Improve Your Coverage

To better protect yourself and your finances, consider the following options:

- Increase Liability Limits: Opt for higher limits than the state minimum to ensure you have adequate protection in case of a serious accident.

- Add Comprehensive and Collision Coverage: These coverages will help protect your own vehicle and reduce out-of-pocket expenses for repairs or replacements.

- Consider Uninsured/Underinsured Motorist Coverage: This provides additional protection if you’re in an accident with someone who doesn’t have enough insurance.

While South Carolina’s minimum auto insurance coverage meets legal requirements, it often falls short in providing comprehensive protection. By opting for higher coverage limits and additional protection options, you can safeguard yourself from unexpected financial burdens and ensure a more secure driving experience. Insurance is more than just a legal obligation; it’s a critical part of your financial safety net. Don’t leave yourself exposed—consider reviewing and enhancing your auto insurance coverage today.

Contact Us to review your coverage.

Does my credit affect how much I pay for insurance?

May 16, 2024

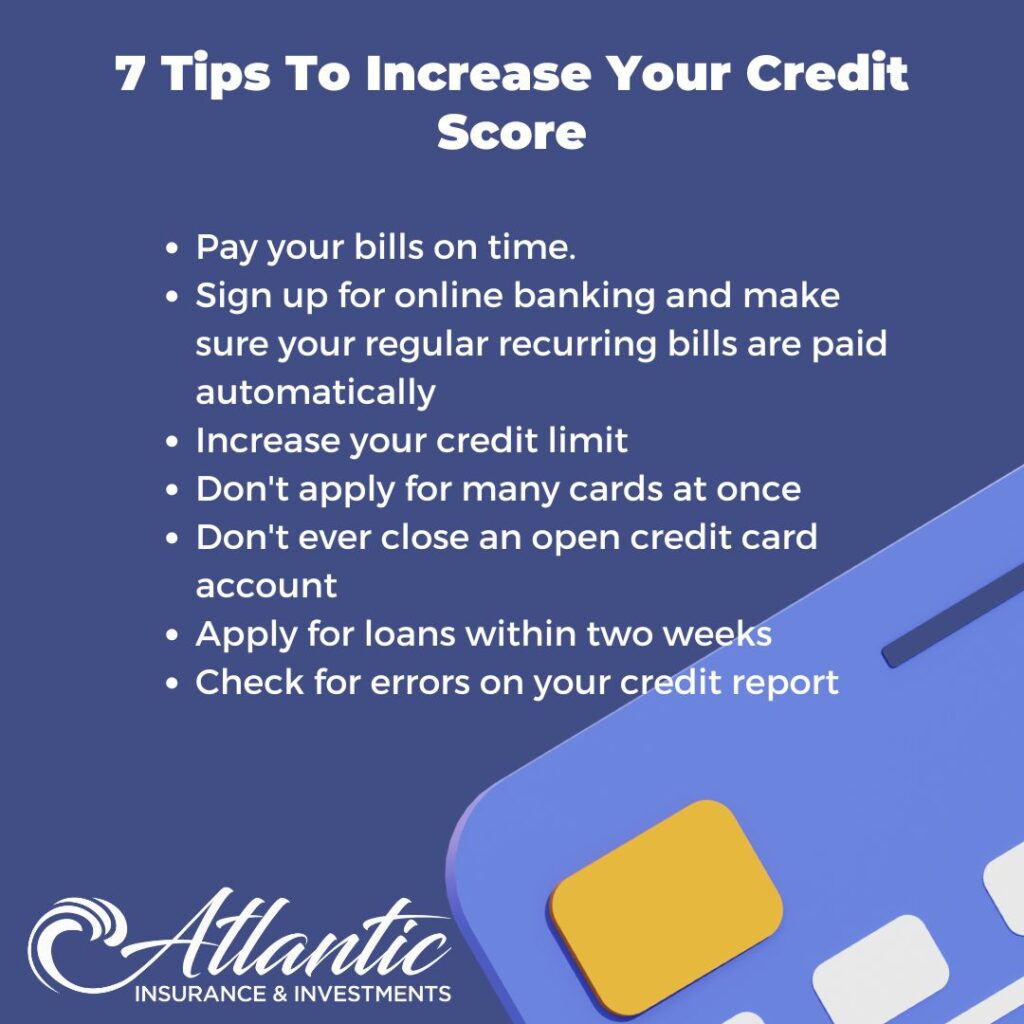

Credit can affect your insurance rate in a few different ways. Insurance companies may use your credit score as one of the factors to determine your risk profile as a policyholder. Generally, individuals with higher credit scores are seen as more financially responsible and are therefore considered lower risk to insure. This can result in lower insurance premiums for those with good credit.

On the other hand, individuals with lower credit scores may be seen as higher risk and may be charged higher premiums as a result. Insurers believe that those with lower credit scores are more likely to file insurance claims, leading to increased costs for the insurance company.

It’s important to note that the use of credit scores in insurance pricing varies by state and insurance company, as not all states allow insurers to use credit information when setting rates. Additionally, insurance companies typically consider a variety of factors when determining rates, so your credit score is just one piece of the puzzle.

If you have any additional questions about how your credit rate factors your premium, give us a call.