Does my credit affect how much I pay for insurance?

May 16, 2024

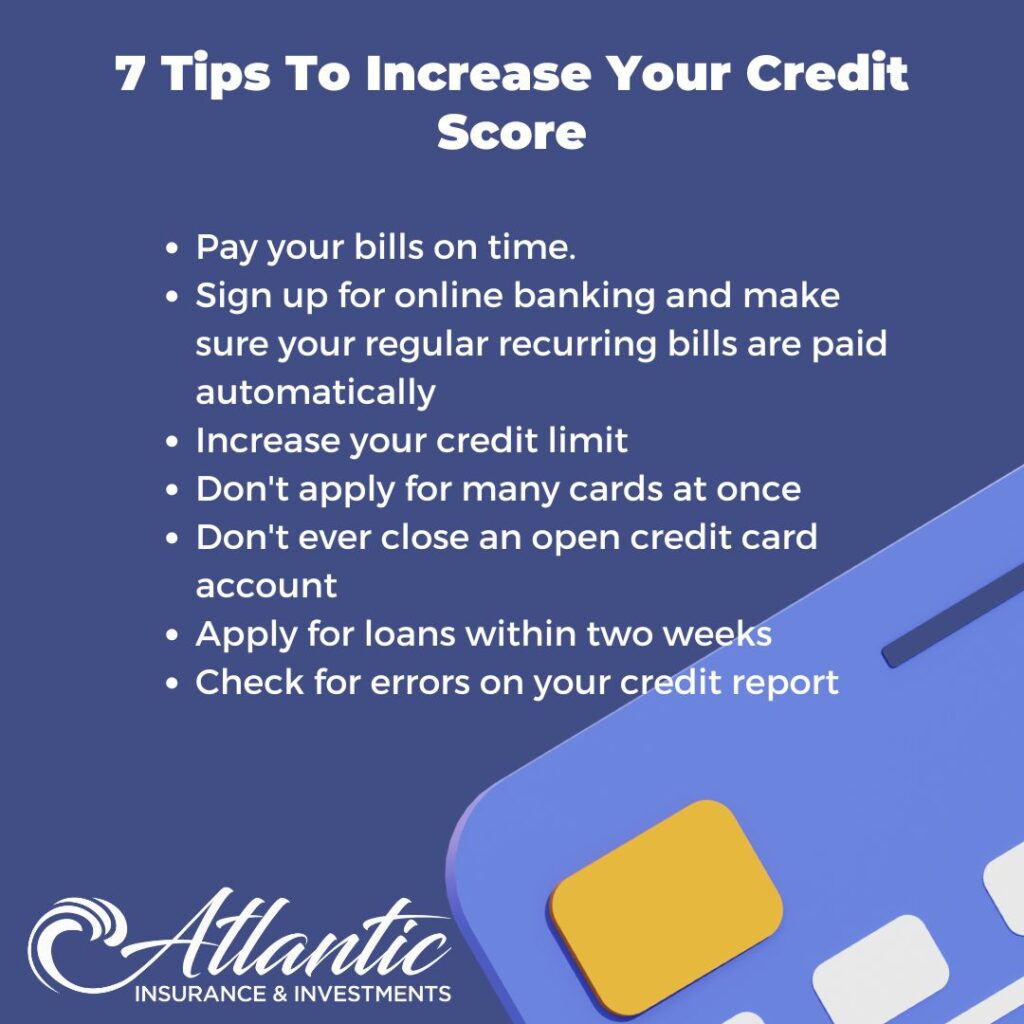

Credit can affect your insurance rate in a few different ways. Insurance companies may use your credit score as one of the factors to determine your risk profile as a policyholder. Generally, individuals with higher credit scores are seen as more financially responsible and are therefore considered lower risk to insure. This can result in lower insurance premiums for those with good credit.

On the other hand, individuals with lower credit scores may be seen as higher risk and may be charged higher premiums as a result. Insurers believe that those with lower credit scores are more likely to file insurance claims, leading to increased costs for the insurance company.

It’s important to note that the use of credit scores in insurance pricing varies by state and insurance company, as not all states allow insurers to use credit information when setting rates. Additionally, insurance companies typically consider a variety of factors when determining rates, so your credit score is just one piece of the puzzle.

If you have any additional questions about how your credit rate factors your premium, give us a call.

Maximize Your Benefits in 2024 with Health Savings Accounts(HSA)

January 16, 2024

Are you ready to take control of your healthcare expenses in 2024?

Discover the power of Health Savings Accounts (HSAs) and how they can benefit you and your family.

What is a HSA?

- Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed to help you save for medical expenses.

- Contributions to your HSA are tax-deductible, reducing your taxable income.

- Funds in your HSA can be invested and grow tax-free.

- Withdrawals for qualified medical expenses are tax-free.

Benefits of HSA in 2024

- Increased Contribution Limits: In 2024, individuals can contribute up to $3,750, while families can contribute up to $7,500, providing more savings potential.

- Triple Tax Benefits: Enjoy tax deductions on contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- Portability: Your HSA account stays with you, even if you change jobs or health insurance plans.

- Retirement Savings: HSA funds can be used for non-medical expenses after age 65, making it a valuable retirement savings tool.

- Control and Flexibility: You decide how to spend your HSA funds, giving you control over your healthcare choices.

How to Maximize Your HSA

- Contribute Regularly: Set up automatic contributions to ensure your HSA grows over time.

- Invest Wisely: Consider investing HSA funds for potential long-term growth.

- Keep Records: Maintain records of all qualified medical expenses for tax purposes.

- Plan for Retirement: Use your HSA as a retirement savings vehicle by contributing consistently.

Qualified Medical Expenses

- Doctor’s visits

- Prescription medications

- Dental and vision care

- Hospital stays

- Laboratory fees

- Preventive care

- And more!

Get Started Today

Atlantic Insurance and Investments works closely with Sara Raub at First Community Bank. She can help answer any additional questions about HSAs and get you a account set up today.

Invest in your health and financial future with an HSA. Start maximizing your 2024 HSA benefits today!

Call or Text: (803) 261-4186

Email: kristin@atlantic-ii.com

Follow us on Facebook for more updates: Click Here

2024 Marketplace Champion

January 9, 2024

I’m honored to announce I’ve achieved national recognition as a #MarketplaceChampion from CMS for the 2024 Marketplace Circle of Champions. I was awarded Elite status after helping more than 100 consumers enroll in Marketplace coverage during Open Enrollment! This is my 5th year reaching Circle of Champions and 4th year reaching ELITE status!

Are you taking advantage of Blue Rewards?

September 25, 2023

Hello! As we are getting closer to the end of the year I wanted to reach out and make sure everyone is getting the most of their health insurance policy! My clients who have individual policies through BlueCross BlueShield of South Carolina have access to a nice rewards program called Blue Rewards.

Blue Rewards pays you for taking certain healthy actions as a way to incentivize you to take care of yourself.

2023 Blue Rewards

- Get a flu shot = $60

- Complete an annual wellness exam (physical) = $60

- Complete a telehealth visit (using BlueCare on Demand) = $30

So you can earn a total of $150 each year per person. Each covered member of your family can earn rewards, so a family of 4 could earn $600 via Blue Rewards each year.

How to Access Blue Rewards &

Get Started

Members can use the link below to activate their Blue Rewards wellness account.

The subscriber will be asked to enter their email address, member ID number and create a password.

Once registration has been completed and a qualifying wellness activity has been completed, a Blue Rewards Visa® card is mailed to the subscriber.

Reward dollars are added to the Blue Rewards Visa® card as each member’s qualifying activities are completed.

Are you interested in learning more about dental insurance?

Call or email me today for coverage beginning as soon as tomorrow.