What are the risks of state minimum auto insurance coverage in South Carolina?

September 20, 2024

In South Carolina, like many states, drivers are required to have auto insurance to legally operate a vehicle. However, the state’s minimum coverage requirements may not be sufficient to protect you in the event of a serious accident. While opting for the minimum coverage might seem like a cost-effective solution, it can expose you to significant financial and personal risks. Here’s a closer look at the dangers of sticking to state minimum auto insurance coverage in South Carolina.

Understanding South Carolina’s Minimum Auto Insurance Requirements

South Carolina mandates that drivers carry the following minimum auto insurance coverage:

**Bodily Injury Liability:** $25,000 per person and $50,000 per accident.

**Property Damage Liability:** $25,000 per accident.

This basic coverage is designed to meet legal requirements and provide some level of protection for others on the road. However, these limits are often not enough to fully protect you or others involved in a serious accident.

1. Inadequate Coverage for Serious Accidents

The minimum liability limits in South Carolina might not cover all expenses associated with a severe accident. Consider the following scenarios:

- Medical Costs: If you’re in an accident where the medical expenses exceed $25,000 per person, you’ll be personally responsible for the remaining costs. Medical bills can quickly add up, especially if there are multiple injuries or long-term treatment required.

- Property Damage: If the damage to property exceeds $25,000, you’ll need to cover the additional costs yourself. This can be particularly concerning if the accident involves expensive vehicles or significant property damage.

2. Limited Protection Against Uninsured or Underinsured Drivers

In South Carolina, like elsewhere, some drivers may not carry adequate insurance coverage. The minimum policy doesn’t include protection for uninsured or underinsured motorists. If you’re involved in an accident with a driver who lacks sufficient coverage, you could be left to cover your own medical expenses and property damage.

3. Absence of Comprehensive and Collision Coverage

State minimum coverage does not include comprehensive or collision insurance, which can be critical:

- Collision Coverage: This helps pay for repairs to your own vehicle after an accident, regardless of fault. Without it, you’ll bear the full cost of vehicle repairs or replacement if you’re in a collision.

- Comprehensive Coverage: This covers damages to your vehicle from non-collision incidents such as theft, vandalism, or natural disasters. Without comprehensive coverage, you risk paying out-of-pocket for these types of damages.

4. Personal Financial Exposure

If you’re involved in an accident and your coverage limits are insufficient to cover all damages, you could face substantial out-of-pocket expenses. This could lead to financial strain, including potential legal judgments and wage garnishments if you’re sued for damages exceeding your policy limits.

5. Legal Consequences

Being underinsured can result in not only financial difficulties but also emotional stress and legal issues. The strain of covering additional costs beyond your insurance policy can be overwhelming. Furthermore, you may face legal complications if you’re unable to fully compensate others for their damages.

How to Improve Your Coverage

To better protect yourself and your finances, consider the following options:

- Increase Liability Limits: Opt for higher limits than the state minimum to ensure you have adequate protection in case of a serious accident.

- Add Comprehensive and Collision Coverage: These coverages will help protect your own vehicle and reduce out-of-pocket expenses for repairs or replacements.

- Consider Uninsured/Underinsured Motorist Coverage: This provides additional protection if you’re in an accident with someone who doesn’t have enough insurance.

While South Carolina’s minimum auto insurance coverage meets legal requirements, it often falls short in providing comprehensive protection. By opting for higher coverage limits and additional protection options, you can safeguard yourself from unexpected financial burdens and ensure a more secure driving experience. Insurance is more than just a legal obligation; it’s a critical part of your financial safety net. Don’t leave yourself exposed—consider reviewing and enhancing your auto insurance coverage today.

Contact Us to review your coverage.

Boating Safety

July 2, 2024

Boating Safety Around Lake Murray (or any lake for that matter): Tips for a Fun and Safe Day on the Lake

Lake Murray, often referred to as the “Jewel of South Carolina,” is a paradise for boating enthusiasts. With its expansive waters and scenic beauty, it’s no wonder that it attracts thousands of visitors every year. However, with great fun comes great responsibility. Ensuring boating safety is essential to enjoying the lake without incident. Here are some essential tips to keep you safe while boating around Lake Murray.

- Know the Boating Laws and Regulations

Before setting sail, familiarize yourself with South Carolina’s boating laws. This includes understanding speed limits, no-wake zones, and right-of-way rules. Compliance with these regulations not only ensures your safety but also that of others on the water.

- Wear Life Jackets

All boats must be equipped with a US Coast Guard-approved wearable Personal Flotation Device (PFD) for each person on board or being towed. Each PFD must be in good condition, easily accessible, and appropriately sized for the wearer. Additionally, boats 16 feet or longer must carry a Type IV throwable device. In South Carolina, anyone under twelve years old must wear a US Coast Guard-approved Type I, II, III, or V PFD when on board a class “A” boat (less than 16 feet long).

- Check the Weather Forecast

Weather conditions can change rapidly on Lake Murray. Check the weather forecast before heading out and stay alert for any changes. If you notice dark clouds, sudden temperature drops, or increased wind, head back to shore immediately.

- Maintain Your Boat

Regular maintenance of your boat is crucial. Ensure that the engine, steering, and safety equipment are all in good working order. Check for any leaks and make sure the bilge pump is functional.

- Have a Float Plan

Inform someone on land about your boating plans. A float plan should include your intended route, expected return time, and contact information for everyone on board. This ensures that someone will know to alert authorities if you don’t return as planned.

- Avoid Alcohol

Operating a boat under the influence of alcohol is illegal and extremely dangerous. Alcohol impairs judgment, coordination, and reaction times, increasing the risk of accidents. Designate a sober captain to ensure everyone’s safety.

- Stay Aware of Your Surroundings

Keep a vigilant lookout for other boats, swimmers, and obstacles. Lake Murray can be busy, especially during peak times. Avoid distractions and maintain a safe speed to react promptly to any hazards.

8. Learn Basic Boating Skills

Enroll in a boating safety course to learn essential skills such as navigation, emergency procedures, and proper boat handling. Knowledgeable boaters are less likely to experience accidents and are better prepared to handle emergencies. The link below is a list of DNR approved boating courses.

Free Boating Course from SC DNR: https://www.dnr.sc.gov/education/boated.html

- Equip Your Boat with Safety Gear

Ensure your boat is equipped with necessary safety gear, including fire extinguishers, flares, first aid kits, airhorn or whistle, PFD and throwable life ring. In an emergency, these items can be lifesaving.

- Be Mindful of Wildlife and the Environment

Lake Murray is home to diverse wildlife. Respect their habitats by keeping a safe distance and avoiding pollution. Dispose of trash properly and be mindful of fuel spills to preserve the lake’s natural beauty.

Boating on Lake Murray is a fantastic way to enjoy the hot summer days in SC, but safety should always be your top priority. I hope these tips help ensure a fun and safe boating experience for you and your friends and family. Get out there, enjoy the water, and stay safe!

Feel free to share your thoughts or additional tips in the comments below. Happy boating!

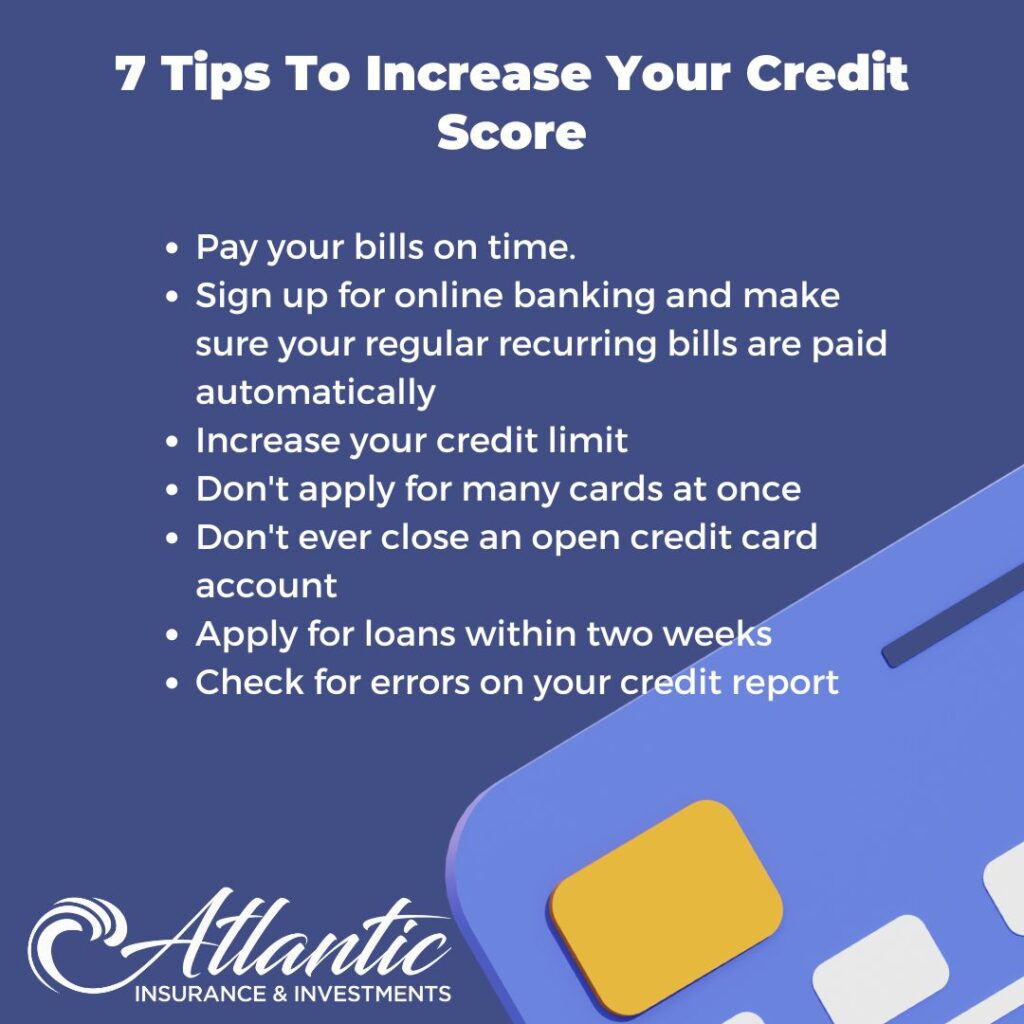

Does my credit affect how much I pay for insurance?

May 16, 2024

Credit can affect your insurance rate in a few different ways. Insurance companies may use your credit score as one of the factors to determine your risk profile as a policyholder. Generally, individuals with higher credit scores are seen as more financially responsible and are therefore considered lower risk to insure. This can result in lower insurance premiums for those with good credit.

On the other hand, individuals with lower credit scores may be seen as higher risk and may be charged higher premiums as a result. Insurers believe that those with lower credit scores are more likely to file insurance claims, leading to increased costs for the insurance company.

It’s important to note that the use of credit scores in insurance pricing varies by state and insurance company, as not all states allow insurers to use credit information when setting rates. Additionally, insurance companies typically consider a variety of factors when determining rates, so your credit score is just one piece of the puzzle.

If you have any additional questions about how your credit rate factors your premium, give us a call.

Understanding Water Backup and Sump Overflow Endorsements

September 20, 2023

Homeownership is a huge investment, and protecting it from unexpected events is crucial. While standard homeowners insurance policies offer essential coverage, they may not always include protection against water damage caused by sump pump overflows or sewer backups. To safeguard your home comprehensively, it’s very important to understand and consider adding a water backup and sump overflow endorsement to your policy.

What are the Risks: Water damage can wreak havoc on your home and personal belongings. Two common culprits are sump pump overflows and sewer backups.

Sump Pump Overflow

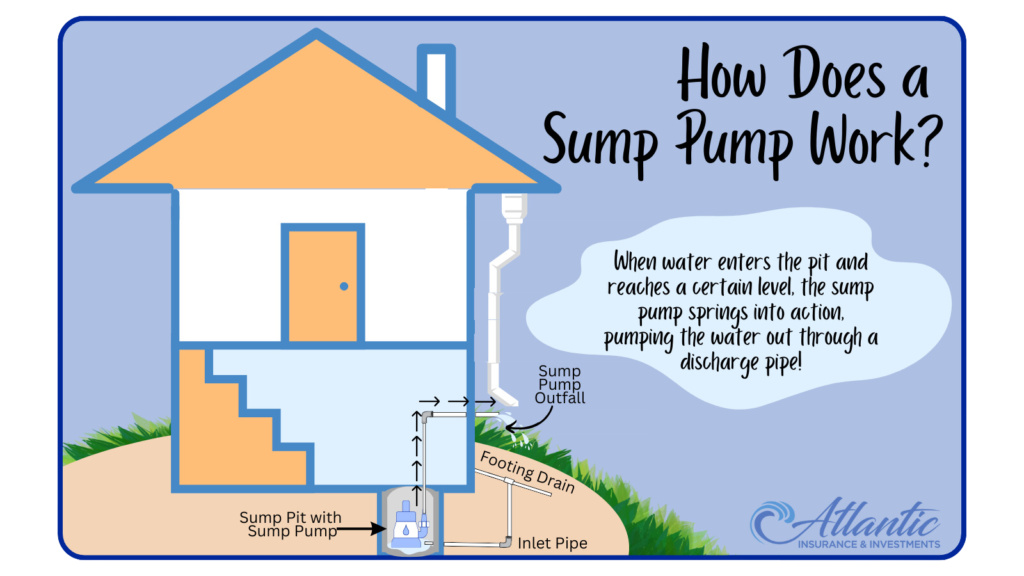

First, what is a Sump Pump? A sump pump is a device designed to maintain a dry and moisture-free basement environment. It achieves this by efficiently removing excess water from a designated pit or basin, typically located in the lowest part of your basement where water naturally accumulates.

How Does a Sump Pump Work? The concept is straightforward: when water enters the pit and reaches a certain level, the sump pump springs into action, pumping the water out through a discharge pipe. This simple yet effective mechanism prevents basement flooding and safeguards your home from moisture-related issues like mold and mildew.

Common Causes of Sump Pump Overflow

Understanding why sump pumps may fail is essential for preventing potential issues. Here are some common causes of sump pump overflow:

- Power Outages: When there’s no electricity, your sump pump cannot function properly, leading to water accumulation in your basement.

- Overwhelmed System: Heavy rainfall or rapid snowmelt (not likely in our area) can inundate the pit, exceeding the pump’s capacity.

- Mechanical Issues: Malfunctioning float switches, stuck check valves, or clogs in discharge pipes can disrupt normal pump operations.

The dangers of sump overflow include property damage, mold growth, electrical hazards, fire risk and health concerns.

Sewer Backup

First, what is a Sewer Backup? Sewer backups occur when sewage flows back into your home through drains, toilets, or sinks. This can result from clogged sewer lines, heavy rain, or tree root intrusion. Cleanup and repairs from a sewer backup can be expensive and unsanitary.

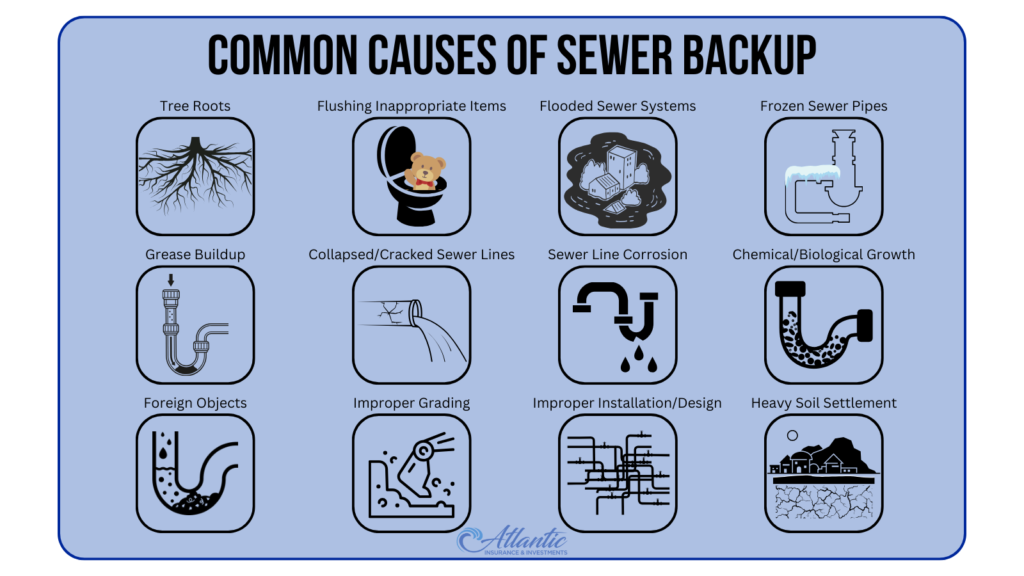

Common causes of Sewer Backup: Sewer backups can be incredibly disruptive and damaging. Understanding the common causes of sewer backups can help homeowners and property managers take preventive measures to avoid these issues. Here are some common causes of sewer backups:

Blockages from tree roots, grease buildup, foreign objects, flushing inappropriate items, collapsed or cracked sewer lines, improper grading, flooded sewer systems, sewer line corrosion, improper installation or design, frozen sewer pipes, chemical and biological growth, and heavy soil settlement.

Preventing sewer backups involves proper maintenance, responsible disposal practices, and, in some cases, professional inspections and repairs. Regularly inspecting and cleaning sewer lines, disposing of grease and inappropriate items in designated containers, and being mindful of what goes down the drain can help reduce the risk of sewer backups. Additionally, consulting with plumbing professionals for periodic inspections and maintenance can be a proactive measure to prevent sewer issues.

Water backup and sump overflow endorsements are essential additions to homeowners insurance, providing valuable protection against water damage events that standard policies may exclude. Before purchasing this endorsement, it’s important to review your specific needs, understand the terms, and consult with your insurance agent. By taking these steps, you can better safeguard your home and belongings from the costly consequences of water damage caused by sump pump overflows and sewer backups.

Questions about your homeowners insurance in SC or NC? Call Kristin Simpson.

Call or Text (803)261-4186 or Email: kristin@atlantic-ii.com

Spring Home Maintenance

April 1, 2023

After a long dark and cold winter, the bright sun and warm winds of the spring are a breath of fresh air!

The only downside? All that sunlight helps you see your leaf-filled gutters, cracked sidewalks, and dead plants in the flower beds. Get your home in shape for spring with this checklist!

- Examine Roof Shingles: Examine the roof to see if any shingles were lost or damaged under the winter snow and ice.

- Check the Gutters: Loose or leaky gutters can cause improper drainage, which can lead to water in your basement or crawlspace during the spring rain.

- Inspect the Concrete: Inspect concrete slabs for signs of cracks or movement. Fill cracks with concrete crack filler or silicone caulk, power-wash, and then seal the concrete.

- Remove Firewood: Firewood stored near the home for winter should be moved at least 18 inches off the ground and at least 2 feet from the structure.

- Check Outside Faucets: Check outside faucets for freeze damage. While you’re at it, check your garden hose for dry rot.

- Repair Window Screens: You will want to open the windows to let the fresh air in. Ensure small holes and tears are repaired so bugs don’t get in.

This is just a short list of items you can do to prepare your home for the spring. Winter was nice and cozy but we are ready for the spring sunshine! While you are preparing your home for the spring, it is a great time to review your homeowners insurance!

Source: https://www.hgtv.com/lifestyle/clean-and-organize/10-home-maintenance-tips-for-spring-pictures

September Is Life Insurance Awareness Month

September 7, 2020

As I am sure most of you are thinking “There really is a month/day for everything!” Yes there is, and September is life insurance. I want to dispel a few myths regarding life insurance.

Myth 1: It’s expensive.

The biggest misconception about life insurance is its cost. There are many affordable plans available. Plans range in price based on a few factors but many are surprised how reasonably priced plans currently are right now.

Myth 2: If you are young and healthy, you don’t need it.

Your life insurance needs depend on many factors, but if possible, it’s better to buy a policy when you’re young and healthy and it costs the least. As you get older you are more likely to develop health problems and the price goes up.

Myth 3: If you have health issues, you can’t get it.

Unless you have severe health conditions, you generally can buy term life insurance. Conditions such as diabetes, high cholesterol and arthritis will mean higher life insurance quotes, but insurance could still be within reach.

Myth 4: If you are a stay-at-home parent you don’t need it.

If you die, who’s going to take care of your children, elderly parents and even your pets? Your surviving spouse may need to hire help, and insurance benefits could help pay for these costs. Stay-at-home parents provide a tremendous benefit to the family, and that void is expensive to fill.

Myth 5: Life insurance through your employer is sufficient.

Group life insurance is a great employer benefit, but typically the payout is fairly low, perhaps twice your base salary. That may not be enough to provide for a young family. Plus, what if you lose or leave your job? A workplace policy doesn’t travel with you, so a personal policy is the safest way to ensure your family is taken care of.

If life insurance is something you are interested in please give me a call. I can give you a quote in a matter of minutes.

Why choose Atlantic Insurance?

August 7, 2020

The main reason why our clients choose Atlantic Insurance is because we are an independent agency. That means we offer more insurance options along with a wide variety of coverage selections and prices. We will do the shopping for you! At Atlantic Insurance we will make sure you are getting the best policy at the best price.

Atlantic Insurance works with multiple lines and carriers. This means we can offer more products that can best meet all your needs. You can get auto, home, health, life, business insurance and more, all in one place, with the help of one agent. To learn more about what we offer please visit our website.